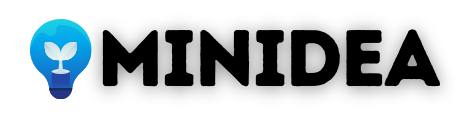

Many people want to invest in the stock market, but they don’t have the capital to invest. However, they can invest in inexpensive stocks by selecting them. In such a situation, buying shares under ₹100 can be a good option for better returns. Because shares under ₹100 are very cheap and can easily be purchased by middle-class people.

While there are many stocks under ₹100 in the stock market that can be invested in, selecting a good stock can be quite challenging. After extensive research, I’ve brought you a list of the best stocks under ₹100.

List of Stocks Under 100 Rupees in India

| Stock Name | Close Price ₹ | Market Cap (In Cr) | 1Y Return % |

| Suzlon Energy Ltd | 83.45 | 113869.45 | 222.82 |

| Indian Overseas Bank | 58.44 | 110465.7 | 33.27 |

| GMR Airports Ltd | 94.53 | 99814.0 | 58.21 |

| IDBI Bank Ltd | 89.15 | 95857.67 | 26.10 |

| NHPC Ltd | 94.65 | 95076.25 | 70.54 |

| Vodafone Idea Ltd | 10.47 | 72975.71 | -4.82 |

| Yes Bank Ltd | 23.00 | 72097.84 | 27.50 |

| UCO Bank | 47.93 | 57304.91 | 9.30 |

| IDFC First Bank Ltd | 72.83 | 54496.74 | -22.19 |

| Central Bank of India Ltd | 58.68 | 50939.75 | 19.88 |

In this list, we’ve included stocks under ₹100 that are fundamentally strong. Furthermore, the company’s business and profits are growing. It’s important to consider these factors before investing in the market.

Introduction To Stocks Under 100 Rs In Hindi

Stocks priced under ₹100 are typically small-cap or penny stocks. Most of these companies operate in sectors like technology and energy. These offer good returns and are likely to perform well in the future.

Suzlon Energy Ltd

Suzlon Energy Limited is a great stock that has delivered excellent returns to its investors. The stock is currently 3.10% off its 52-week high, with a one-year return of 222.82%. Its market capital is approximately Rs 113,869.45 crore, which has happened in a very short time.

Suzlon Energy Limited is a Green Energy Power Generator Company. The company provides renewable energy solutions and operates in the field of wind turbine generators (WTGs). The company operates in approximately 17 countries across Asia, Australia, Europe, Africa, and the Americas.

Indian Overseas Bank

Indian Overseas Bank mainly provides services related to domestic deposits, domestic advances, foreign exchange operations, investments, micro, small and medium enterprises. Indian Overseas Bank has a market capitalization of approximately ₹110,465.70 crore. Its one-year return is approximately 33.27% and the stock is at its 52-week high.

NHPC Ltd.

NHPC Limited is an Indian company primarily focused on the generation and sale of electricity. The company is currently constructing hydroelectric projects with a total capacity of approximately 6,434 megawatts (MW). NHPC Limited has a market capitalization of ₹95,076.25 crore.

NHPC also has several subsidiaries which include Downstream Hydroelectric Corporation Limited, Bundelkhand Solar Energy Limited, Jalpower Corporation Limited and Chenab Valley Power Projects Private Limited. Currently the share price of this company is Rs 81 and it can give good returns in the coming time.

Vodafone Idea Ltd

Vodafone Idea Limited, an India-based telecommunications company, provides 2G, 3G, and 4G services. The company also provides voice, broadband, content, and digital services. Vodafone Idea Ltd. currently has a market capitalization of ₹72,975.71 crore. VI Stock is a great option when it comes to low-cost stocks.

IDFC First Bank Ltd

IDFC First Bank Limited is an Indian bank that engages in corporate/wholesale banking, retail banking, and other banking businesses. IDFC first bank has reported excellent quarterly results in the recent past. Although currently its share price is less than Rs 100, however it has full potential to reach Rs 100 soon.

National Fertilizer Ltd

National Fertilizers Limited (NFL) is an Indian public sector company engaged in the marketing of agricultural products. The company primarily produces urea, ammonium nitrate, and phosphorus-based fertilizers. The company sells its products both within India and abroad.

India is an agricultural country, which could lead to significant growth for this company in the future. NFL’s growth is primarily dependent on agriculture. The company has performed exceptionally well in recent years.

Investors are always looking for affordable stocks, believing they have high growth potential. However, these types of stocks have performed well over the past few years and generated profits for their investors.

Always choose stocks that have a solid business model, competitive advantages, and strong financials, while also benefiting from earnings growth. Our team has done research and shared a list of some popular stocks, from which you can buy any stock.

Keep visiting Minidea for the latest website updates and follow us on Facebook where you’ll receive updates on digital marketing and SEO.